What do online travel agents (OTAs) mean for hotel bookings?

- What is the definition of OTA in the hospitality industry?

- The hotel’s own website

- Global distribution systems (GDS)

- Wholesalers

- The all-important hotel channel manager

- Are online travel agents (OTAs) good for the hotel industry?

- How much OTA commission do hotels pay?

- We recommend the 12 best OTAs available on the Internet

- OTAs versus direct bookings: which is best?

- How important is the OTA channel to hotels?

Online travel agents (OTAs) are one of the key distribution channels that hotels have at their disposal in order to market and sell their room nights.

This article investigates the relationship between hotels and OTAs and answers some key questions:

Are OTAs good for the hotel industry?

How much OTA commission do hotels pay?

How important is the OTA channel to hotels?

But before doing that, we are going to put OTAs into context and describe their position along with the other distribution channels that hotels use.

Hotels are advised to diversify their marketing strategy, and also strategically distribute their inventory on several OTAs and online marketplaces.

A healthy mix of OTA listings, metasearch advertising, social media promotions, email campaigns, travel host agency services, and partnerships with local businesses, is a good approach for hoteliers.

Let’s start at the beginning.

What is the definition of OTA in the hospitality industry?

OTA equals Online Travel Agency.

They are online companies that allow users to book different travel-related services directly from the comfort of their homes via the Internet.

They are agents that outsource services and resell travel, hotels, vacation packages, etc organized by other companies.

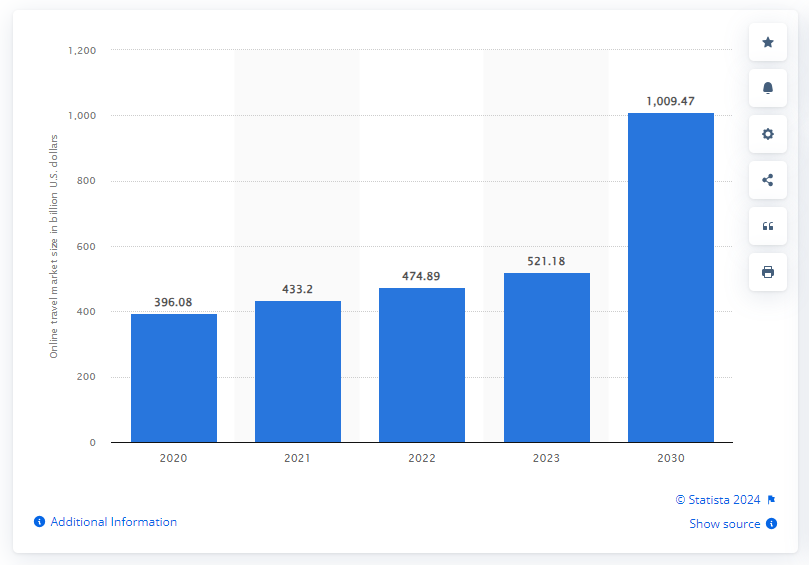

According to the Statista website, analyzing and projecting 2023 data, the travel sector will practically double in size by 2030.

This projection has real support from this type of practice’s popularity over the last few years.

Above all, with the use of cell phones and online applications, which allow last-minute flight bookings at really affordable prices.

The OTAs have become an authentic solution for the user in an increasingly dynamic world.

The hotel’s own website

In many cases, the primary channel for selling rooms is a hotel’s own website, or that of the parent brand.

It is the only online distribution channel that allows hoteliers to sell directly to different types of travelers in one place. Sites need to load quickly and be optimized for smartphones and tablets.

A high quality booking engine is essential to provide a seamless and smooth booking experience for guests. Hotelminder has a list of the ten best website booking engines of 2020.

Hoteliers need to practice search engine optimization (SEO) in order for their websites to appear in the top results on Google, Bing and other metasearch engines. On average, 53.3% of website traffic is organic, resulting from people asking questions and clicking through to sites providing the top-ranked answers.

Global distribution systems (GDS)

A GDS is a consolidated reservation network, primarily used by travel agents, to reserve real-time flight, hotel and rental car inventory for their clients. Sabre, Amadeus, Travelport are well-known global distribution systems.

As a distribution channel, a GDS provides one connection to multiple travel agency systems and allows hoteliers to keep their listing updated across all networks through one interface. GDS create broad global exposure for hotel inventory and can help fill last-minute vacancies.

Generally, a GDS charges hoteliers a one-off setup cost and then take either a percentage or a fixed fee per booking. These costs differ from one GDS to another.

Wholesalers

Also known as bed banks, wholesalers are third parties who source hotel room nights in bulk at heavily discounted rates and sell them, at a mark-up, to travel agents and OTAs.

They are typically used by large independent hotels and chains to maximize occupancy and guarantee a certain occupancy rate. Wholesalers can help hotels reach international consumers they might not reach otherwise, although they do not interact directly with travelers.

The all-important hotel channel manager

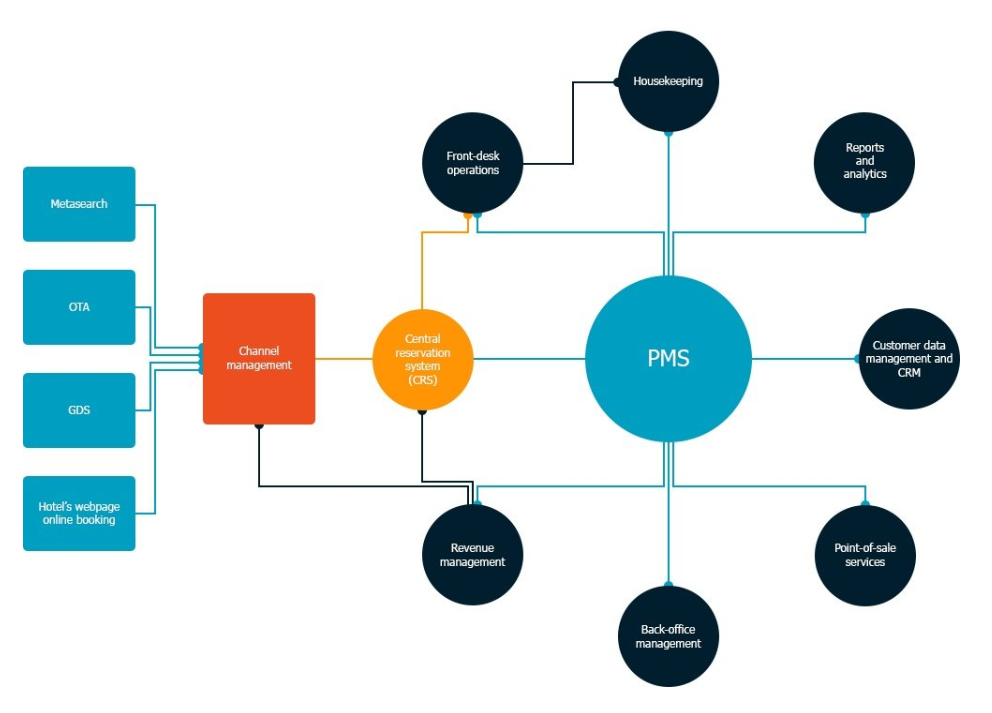

A hotel channel manager is a vital piece of the hotel tech stack. It connects hotels to their online distribution channels – OTAs, GDS, wholesalers, and more – so they can be managed from one location in a fraction of the time.

Using a channel manager automates the exchange of rates, availability and reservations, often at near real-time speeds.

This enables hotels to make updates once and reproduce them across all of the channels they work with – saving time, increasing accuracy and reducing problems with overbooking and rate parity.

It also allows hotels to expand their distribution network by linking with online channels they may have previously not known about.

Chart 1 shows the position of the channel manager in the context of a hotel’s entire property management system.

The channel manager is positioned between the hotel’s chosen sales and marketing channels and its central reservation system (CSR).

Chart 1 The hotel channel manager within the wider property management system

Source: Altexsoft

Are online travel agents (OTAs) good for the hotel industry?

From the hotelier’s perspective, there are important advantages associated with using OTAs to sell rooms.

Market reach

OTAs offer access to an enormous marketplace of consumers actively shopping for travel. On average, more than 1.5 million room nights are reserved each day on Booking.com. Annually, more than 16 million room nights are booked via Expedia. So understanding what is a booking system, in a broader sense, is essential for success.

OTAs give hoteliers access to customers who would be difficult for them to reach directly, for instance, international travelers. OTAs translate hotel listings into several languages, something that would be expensive for most independent hoteliers to achieve.

OTAs act as the main point of contact for amending or cancelling bookings, freeing up hoteliers to focus on the guest experience in-house.

The Billboard Effect

For consumers, the attraction of OTAs is clear. If you have no loyalty to a particular hotel brand, but simply need to book accommodation in a specific city on a specific date, an OTA provides a range of hotels to compare instantly without having to open up several different websites. After consulting an OTA, many customers will go directly to their chosen hotel’s website and, if they find it user-friendly, will book direct. This is known as the Billboard Effect because the OTA is acting as an advertisement for the hotel.

Packages

OTAs can provide opportunities to participate in packages, e.g. bookings that include a flight and accommodation, or car hire and accommodation.

Expedia research shows that travelers who purchase packages book earlier and cancel less frequently than consumers who make standalone bookings. This results in higher rates for the hotel and reduces the need for last-minute discounting.

Pay as you go

When hoteliers form successful partnerships with OTAs they reduce their inventories of un-booked rooms and boost revenue, especially during off-peak periods. OTAs are often the best way of selling distressed inventory, such as that last-minute night in the middle of a busy week that is still free.

Hoteliers only pay OTAs when they actually fill rooms. Empty rooms mean no commission for the OTAs too, so both parties have a vested interest in selling as much as possible.

Market intelligence

OTAs gather huge amounts of market information and data. Hoteliers can take a lead from OTA data on customer profiles, booking habits and location trends to inform their own marketing and pricing strategies.

Many OTAs provide tools that allow hoteliers to identify and monitor their key competitors, thus benchmarking their own performance.

How much OTA commission do hotels pay?

OTAs charge a fee per hotel booking which is typically a percentage of room revenue. Booking.com says its average global commission rate is 15%. The rate varies depending on the type of hotel and its location.

Research estimates that independent hotels pay Expedia commissions of 15-30% as opposed to large hotel brands that pay less, in the region of 10-15%.

Not all OTAs charge high commission. Although the OTA marketplace is dominated by Expedia and Booking Holdings, there are estimated to be some 400 OTAs in operation today.

Gomingo, a new London-based OTA, is currently charging zero commission to its partners for a limited time. The company pledges to only ever charge a maximum of 15% commission. Partners include some big hotel brands such as Novotel and Wyndham.

We recommend the 12 best OTAs available on the Internet

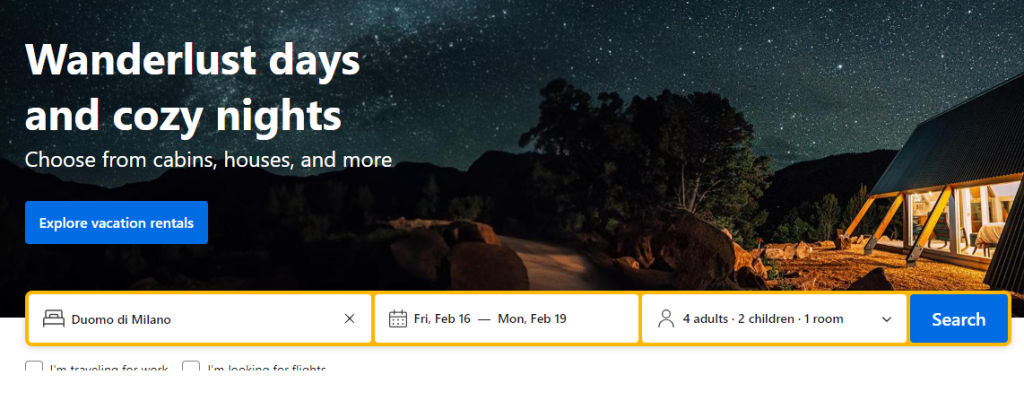

Booking

Booking is one of the leaders in the world of online booking.

This company, founded in Amsterdam in 1996, has not only a wide range of hotel accommodations on offer but also flights, cars and tourist attractions.

Thanks to its system of user ratings, an user can find out in seconds how the treatment and service in general has been from someone who has already had the experience.

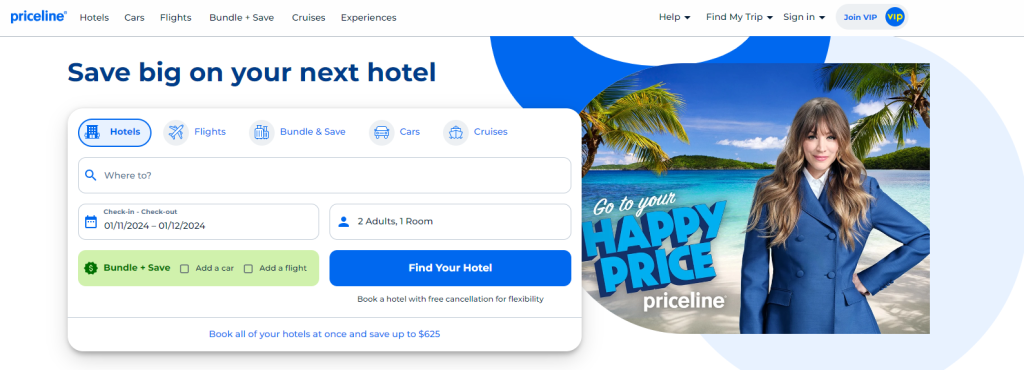

Priceline

Priceline is mainly known for its “name your own price” style, which allows users to bid on a hotel room, car rental or travel ticket. If the offer is accepted, you can enjoy the service.

It was founded in 1997 and is part of the Booking Holdings group.

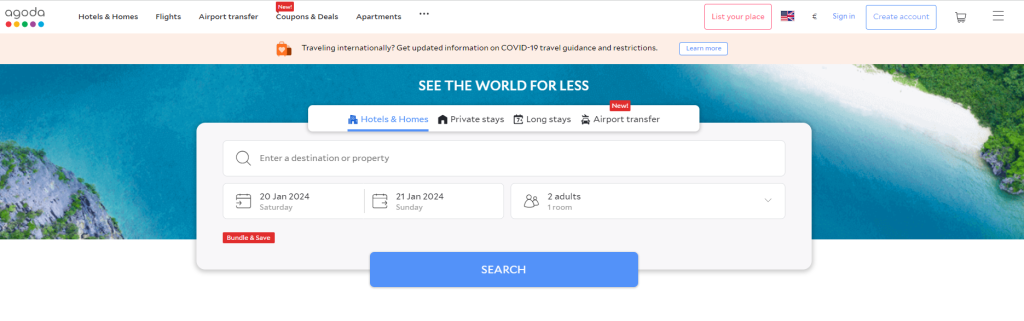

Agoda

Agoda is a website founded in 2005 with a strong presence in Asia.

Over the years, its brand has grown to become a reference for all those western travelers who need to know the other side of the world.

Its extensive service includes accommodation in hotels or residences to a special transportation service from the airport to the rented place called “Airport Transfer”.

This can be very useful to be able to move to Asian countries that have different cultures and realities than those offered in Europe or the United States.

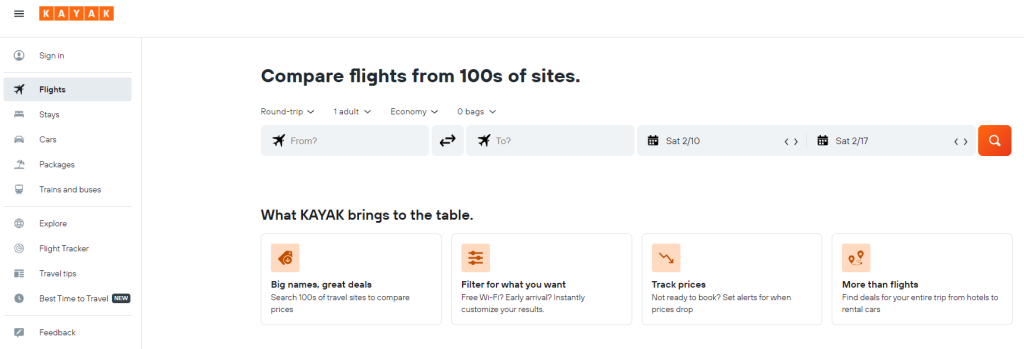

Kayak

Kayak is a travel metasearch engine and one of the price comparators par excellence when looking for good prices for tickets to enjoy a vacation.

Its service includes “price alerts” that notify users about fare changes to help them get more benefits when traveling.

It also includes other interesting tools such as a trip planner, heat maps and price forecasts, making it an essential reference website.

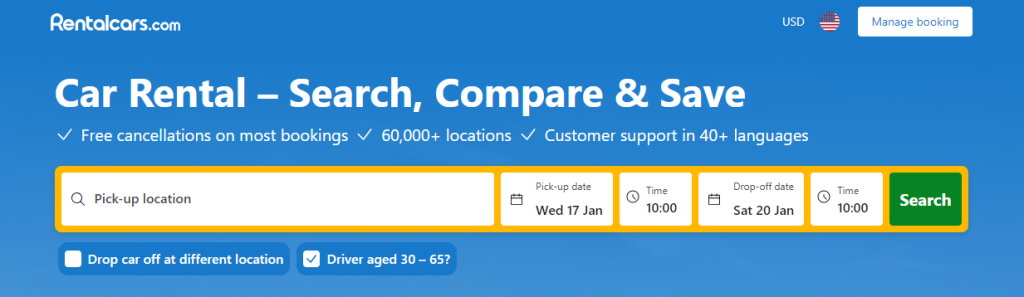

Rentalcars

Rentalcars is the most important reference for those travelers who want to enjoy a few days in Europe.

It was founded in 2004 in the United Kingdom and today has more than 60,000 locations in different parts of Europe and the world with a wide range of vehicles to choose from.

It has a very intuitive interface and the possibility to connect immediately to different car rental companies to have the best price in the market for the selected days.

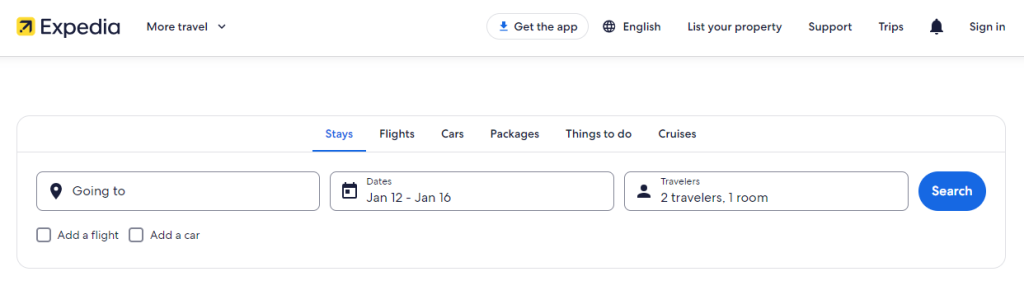

Expedia

Expedia is one of the pillars of the world of OTAs.

A key player in the travel industry, it was founded in 1996 and is today one of the major references in the United States.

Its services include everything from hotel reservations, flights and car rentals to the possibility of hiring a complete vacation package.

One of its key features is its rewards system, which allows users to accumulate points and then exchange them for exclusive benefits.

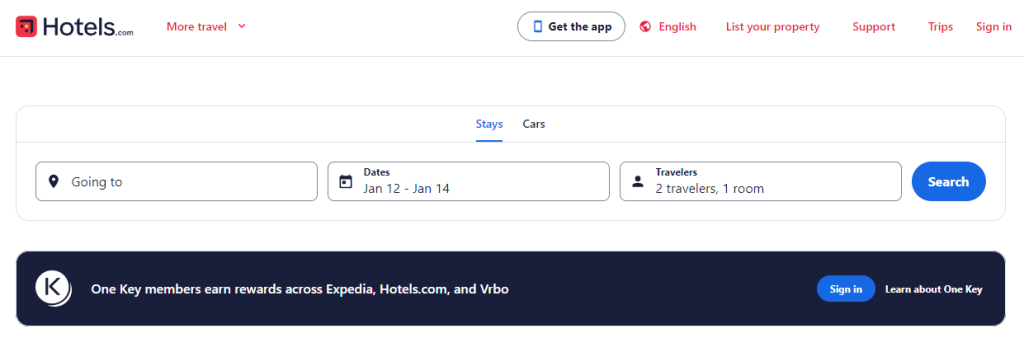

Hotels

Hotels have become a reference thanks to their long history and extensive catalog of services and locations.

Founded in 1991, today it has offers in more than 200 countries around the world.

Its main feature is its loyalty program, which offers travelers one free night for every ten nights booked.

Undoubtedly, an excellent opportunity for those who are frequent travelers.

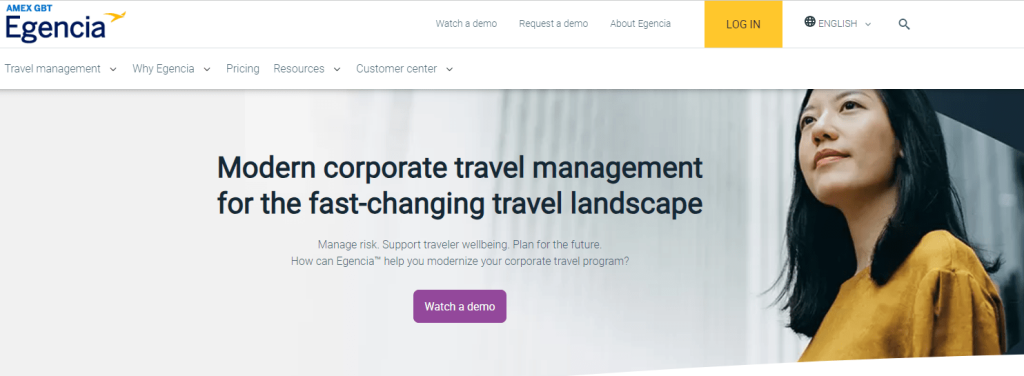

Egencia

Unlike other OTAs, oriented to the general public, Egencia is characterized by its service to companies and business travelers.

It offers comprehensive solutions for the corporate sector combining technology with personalized attention.

In addition, as part of its service, it offers tools with expense reports, travel policy management and tracking of each of those compliances.

All this is to optimize corporate travel expenses offering companies a solution to this specific need.

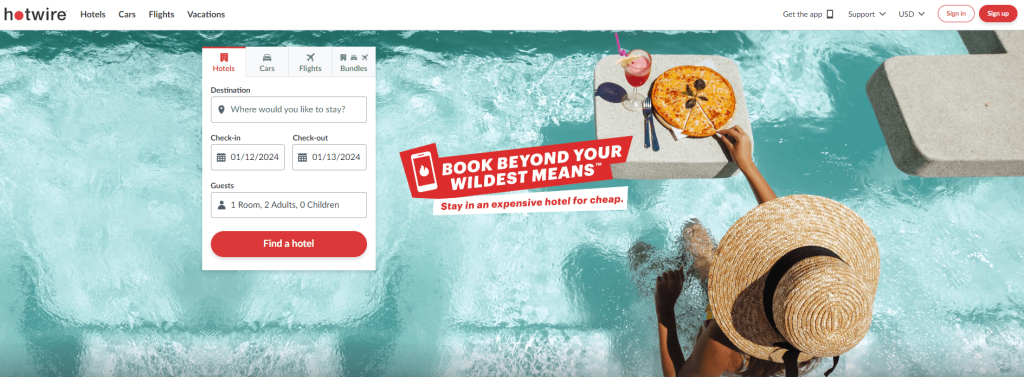

Hotwire

Referring to its name, Hotwire specializes for those travelers looking for “last minute” deals.

These are exceptionally low rates on hotel, flight and accommodation bookings.

The closer you get to the travel date, the greater the offer.

In addition, its section “Hot Rate” offers very important discounts especially in hotels and car rentals.

This allows users to access high-quality sites at really low prices.

Classic Vacations

Part of the Expedia Group, Classic Vacations focuses on those travelers who want to live a personalized and tailor-made luxury experience.

Its goal is to provide the user with an exclusive vacation, which is why its catalog offers stay in high-end resorts, private villas and fully customized tours.

In addition, it has unique assistance and specialized personnel in the sector so each experience is unique.

Expedia Cruises

Expedia Cruises is focused on the booking of cruises to satisfy the demand of those who dream of a different vacation from the maritime world.

The interesting thing about this excellent portal is its cruise comparator, in which the user will be able to set his filters to find the cruise that best suits his needs.

Opodo

Opodo is a company founded in 2001 and with a very special feature which is the possibility of establishing travel itineraries through the combination of flights with different airlines.

This functionality and unique feature offer the user flexibility and savings making it a very attractive option.

OTAs versus direct bookings: which is best?

OTA commission levels have caused heated debate in the hotel sector for several years.

In fact, as a consequence of the “direct booking wars,” an entirely new wave of digital marketing suppliers has sprung up.

Companies like Cloudbeds, Avvio and HotelREZ offer services to help hotels receive a greater proportion of direct bookings through their own websites, thus cutting down on their sales expenses.

However, the ”OTA versus direct booking” debate has now moved on. Most hoteliers understand that OTAs are here to stay and that they need a mix of direct and OTA bookings.

In fact, although hoteliers have been critical of high OTA commission rates, the real costs of direct booking need to be considered too.

These costs include website and booking engine maintenance, the time spent on search engine optimization, newsletter and email marketing, advertising, and so on.

So the total costs of direct bookings versus OTA commission need to be accurately compared.

Having done so, many independent hotels and accommodation providers have come to the conclusion that the most cost-effective business model for them is to have a simple website (sometimes even without a booking engine) and use OTAs for the majority of their bookings.

How important is the OTA channel to hotels?

In a Hotel Analyst report, Macy Marvel argues that the attention paid to the OTAs is out of proportion to their actual importance as a distribution channel.

She notes that still roughly half of hotel bookings worldwide arrive via conventional channels e.g. walk-ins, telephone, fax, email and only about 20% of the hotel stock in China and India, for instance, is bookable through online channels.

The major hotel brands, often the loudest critics of online travel agencies, actually rely on OTAs for about a quarter to a third of their online bookings, or just 10 to 15% of total bookings, writes Marvel.

The situation is radically different for independent hotels, however, especially those outside major cities, who might take as much as 70% of their bookings through OTAs.

Subscribe to

our newsletter

Yay! You are now

subscribed to our

newsletter

Mize is the leading hotel booking optimization solution in the world. With over 170 partners using our fintech products, Mize creates new extra profit for the hotel booking industry using its fully automated proprietary technology and has generated hundreds of millions of dollars in revenue across its suite of products for its partners. Mize was founded in 2016 with its headquarters in Tel Aviv and offices worldwide.

Related Posts

What is OTA in Revenue Management and how to do it right?

11 min. A hotel revenue management strategy is usually a comprehensive strategy encompassing various analytics and demand forecasting tasks to custom tailor pricing and distribution strategies. While there are many independent hotels, most hotels list their accommodations through OTAs. But where does that leave OTAs? The OTA market is quite dynamic and has some serious […]

5 OTA Advertising Strategies That Work

8 min. Online travel agencies or simply OTAs have plenty of opportunities to market their offer to the target customers. Some strategies focus more on generating exposure, while others generate more leads and increase conversion rates. There are also more and less efficient advertising strategies. One common question that continues to trouble online travel agents […]

The Most Complete Hotel Wholesalers and Bed-Banks List

28 min. Finding a professional and reliable hotel wholesaler is not an easy task. There are dozens of hotel wholesalers to choose from on the current market. However, they are not all the same. Some are better than others in terms of the commercial conditions they offer, the variety of hotels they have access to, […]